Japan's Corporate Resurgence

Japan's corporate resurgence on track

After their strongest start to a year in a decade, Japanese equities have traded sideways since June, but the structural reforms underpinning the country’s improving economic prospects and buoyant stock prices continue to gather momentum.

So it’s important to stay focused on the emerging opportunities in a country that, because of its lost decades of deflation, so often gets overlooked or, at worst, written off as a source of potential returns for UK-based investors.

Take the update recently issued by Tokyo Stock Exchange (TSE) on progress towards listed companies achieving share prices that at least match the value of the business, known in the jargon as price-to-book ratio (PBR) of 1.0. As part of this initiative, management teams were required to disclose their cost of capital and specifically address how they planned to achieve a return on equity (ROE), calculated by dividing net income by shareholder’s equity, above 8%, which is deemed consistent with achieving a PBR above 1.0.

Alliance Trust’s specialist Japan manager, Dalton Investments, says this request may seem anodyne in a country with a shareholder model like the US. But it was actually revolutionary in that, for the first time, Japanese company managers, usually so keen to balance a wide range of competing interests, ranging from employees to customers and suppliers, often at the expense of shareholders, were being mandated to explicitly focus on something which until then had often been viewed as none of their concern: namely the price of their stock!

Dalton says the minutes of the TSE meeting held on 29 August 2023, provided an insight into just how serious the TSE was about its initiative.

“To us, the message from the minutes of the meeting and associated presentation materials was clear:

- The TSE has no intention of slowing down its initiative and Japanese company management will continue to face pressure from the TSE to comply

- Companies should disclose their ROE targets

- Japanese companies need to improve their PBR to 1.0 at a minimum

- Importantly… Companies that have a PBR of above 1.0 are not excused – they too need to actively consider their cost of capital and disclose their plans.”

Update on progress

Source: TSE as of 30 September 2023

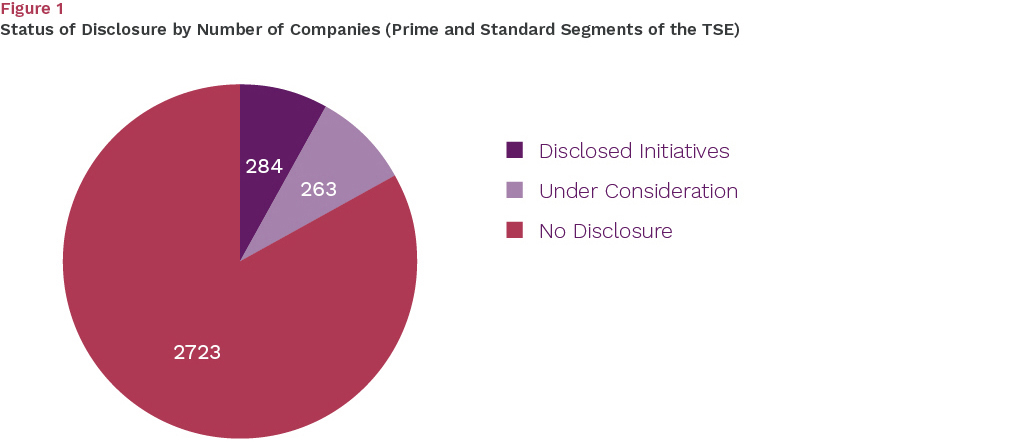

As Figure 1 shows, there has been a steady uptake of the TSE’s request, with 284 companies making their public disclosures and another 263 stating that these are under consideration. However, this leaves a sizeable part of the listed universe (2,723 companies to be precise) which have yet to comply.

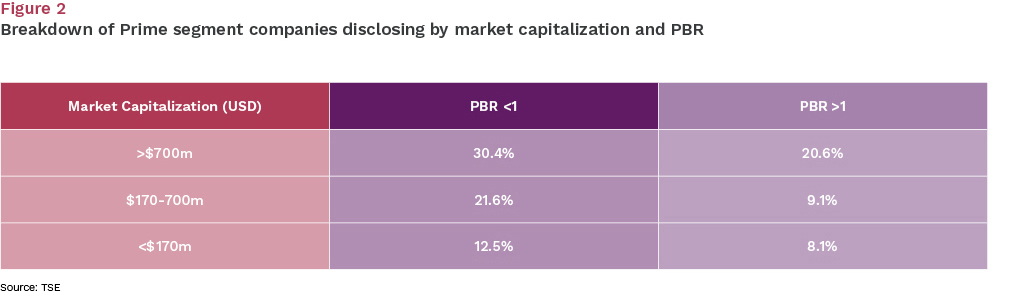

Source: TSE as of 30 September 2023

Figure 2 makes it clear which companies have been quickest on the uptake. The larger companies in Japan are clearly feeling the greatest pressure to comply, particularly if they have a persistently low PBR. It is also fair to note that these larger companies often have greater resources to spend in undertaking and disclosing these important reviews. Nevertheless, the TSE has made it clear that there are no exceptions for smaller market capitalisations or even for higher PBR companies – all companies need to comply with the request. While there will likely be a continued stream of disclosures coming particularly from large low-valuation companies, Dalton also believes there will be significant opportunities in the small-cap space as these companies play catch-up. So, what exactly is in the initiatives disclosed so far? Of the 284 disclosures so far made:

- 72 provided their cost of capital

- 235 set one or more explicit targets for their business: 199 ROE targets, 57 Return of Investment Capital (ROIC) targets, 39 Price/Book targets

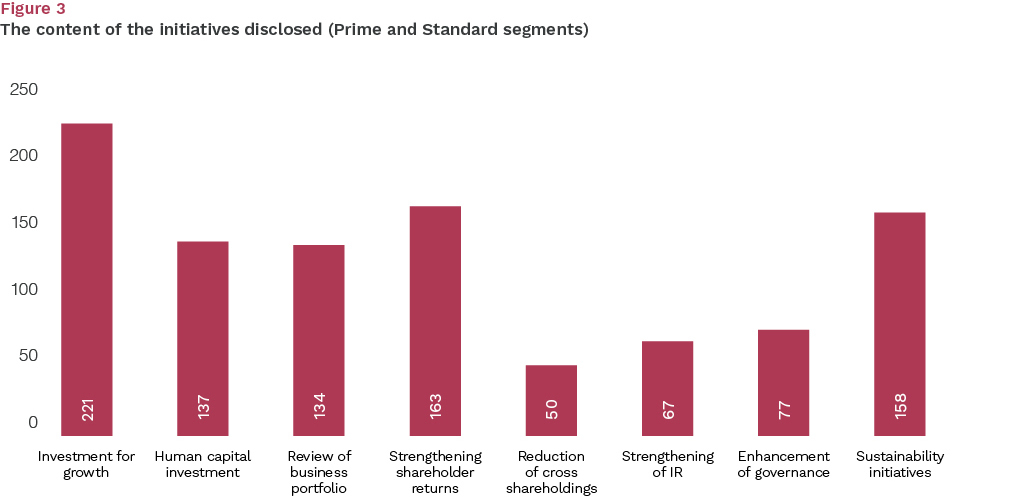

Source: TSE as of 30 September 2023

Figure 3 attempts to summarise the content of the text of the initiatives, grouping them into broad categories where the management teams want to drive improvements. Clearly, all of these are positive steps, and Dalton sees the evidence of continued improvements in shareholder returns (record buybacks and dividends) as well as the start of a rationalisation of the company’s business structures, including selling off or closing low profitability or non-core operations.

It is also encouraging to see Japanese firms embracing sustainability initiatives, given these continue to lag global standards. However, Dalton is particularly interested in the 50 companies that discussed the plan to unwind their cross shareholding structure.

“We view cross-shareholdings (where inter-related companies such as suppliers and customers will hold stakes in each other’s business) as one of the biggest remaining challenges in the Japanese equity market, and intend to make this a major focus of our engagement over the coming year. In our view, the TSE reforms supply strong ammunition to engagement-focused managers such as Dalton in driving positive change.”

The remarkable case of Aisin

Dalton cites Aisin as a poster child for the new mood sweeping Japanese boardrooms. “Aisin is an $11bn market capitalisation company that produces components and systems for the automotive industry, as part of the Toyota Group of Companies (Aisin is the fourth biggest division in the group). The company is 40% controlled by the Toyota Group, and has historically acted in unison with the Toyota management and given limited focus to its minority shareholders. Despite this, and driven by the TSE’s demands, on 14 September the company gave a ‘Mid/Long-term Business Strategy Briefing’, which included some remarkable elements:

- Completely selling out of its (mostly Toyota Group) cross-shareholdings (JPY 250bn in total)

- Increasing shareholder returns through share buybacks and dividends

- Transferring out or closing non-core and low profitability business lines

- Setting explicit ROIC (13%) and PBR (>1x) targets

- Outlining a specific focus on key sustainability issues such as carbon neutrality

“In our view, if a company like Aisin can move to completely unwind its cross-shareholdings, then this is an extremely positive sign for the wider Japanese market.”

Dalton concludes:

“We are truly encouraged by the TSE’s continued and persistent reform agenda and believe it is having a profound impact on the Japanese market. As engagement-focused investors, being able to speak to Japanese company management in the common language of cost of capital, valuation and ultimately share price is revolutionary”.

“With the Japanese market’s strong performance (at least in Japanese Yen!) in recent periods, we are often asked whether we believe the opportunity is over in Japan. On the contrary, we believe we are still in the early stages of a multi-year opportunity in the country, as the management of Japanese companies respond to the pressure to drive better returns for shareholders”.

Source: Bloomberg as of 30 September 2023

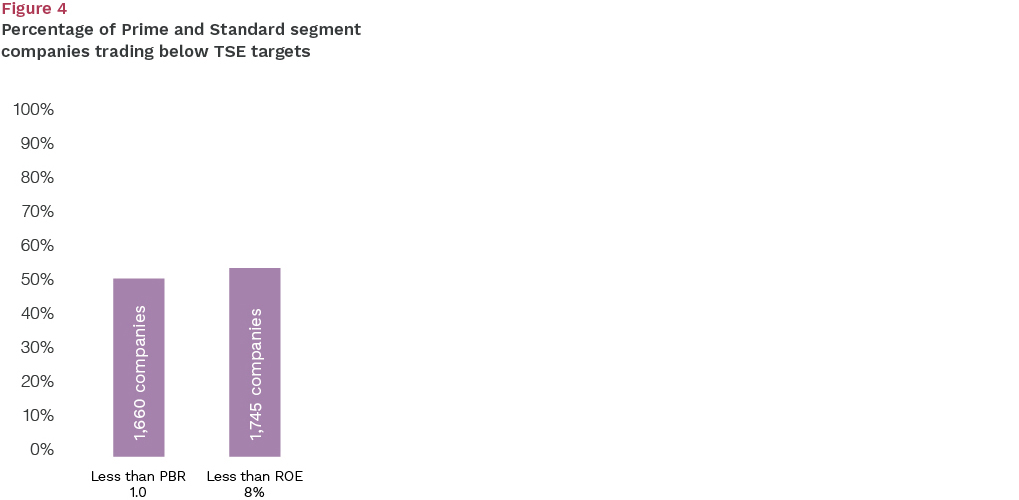

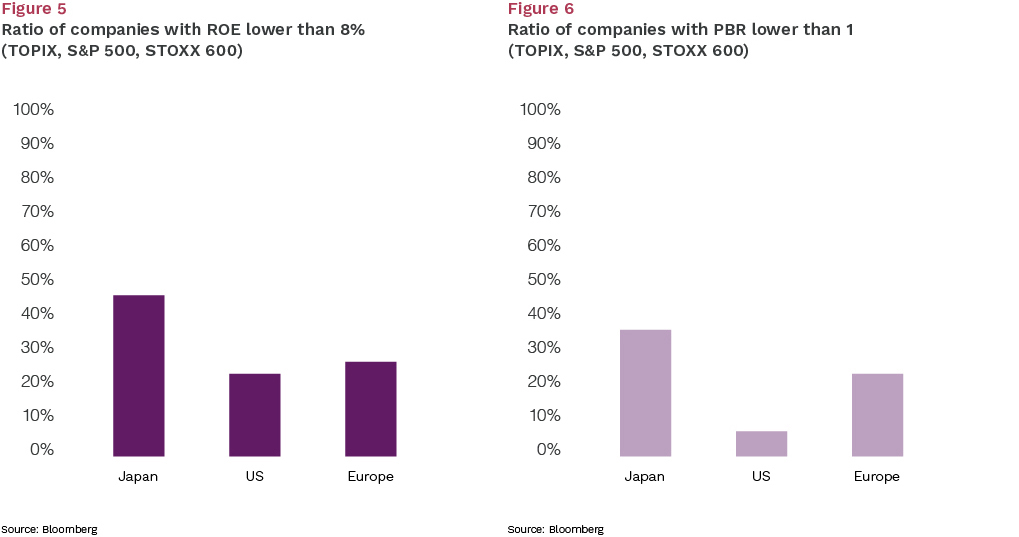

“As Figure 4 shows, there remain a huge number of companies listed in Japan with metrics below the TSE’s minimum targets, most of which are yet to make public disclosures of their plans to address these failings. Even if we only consider the large-cap skewed TOPIX index, we see a pronounced gap between Japan and the rest of the world (Figures 5 and 6) on these key metrics, meaning there remains the potential for sustained relative outperformance from Japan.”

Sources: Bloomberg as of 30 September 2023

Jamie Rosenwald is the CIO and Co-Founder of Dalton Investments.

This information is for informational purposes only and should not be considered investment advice. Past performance is not a reliable indicator of future returns. The views expressed are the opinion of Towers Watson Investment Management (TWIM), the authorised Alternative Investment Fund Manager of Alliance Trust PLC, and are not intended as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell any securities. The views expressed were current as at October 2023 and are subject to change. Past performance is not indicative of future results. A company’s fundamentals or earnings growth is no guarantee that its share price will increase. You should not assume that any investment is or will be profitable. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

TWIM is authorised and regulated by the Financial Conduct Authority. Alliance Trust PLC is listed on the London Stock Exchange and is registered in Scotland No SC1731. Registered office: River Court, 5 West Victoria Dock Road, Dundee DD1 3JT. Alliance Trust PLC is not authorised and regulated by the Financial Conduct Authority and gives no financial or investment advice.